As more EU and Asian nations are embracing the benefits of E-Invoicing, Malaysia stands out as a country undergoing a major shift towards mandatory electronic invoicing. This shift spearheaded by the Inland Revenue Board of Malaysia (IRBM), marks a pivotal moment in the country’s digital evolution.

The mandatory use of electronic invoicing will begin in August 2024 for taxpayers with an annual turnover of more than MYR 100 million. The electronic invoicing massification will affect all categories of B2B, B2C and B2G transactions. The phased introduction of E-Invoicing will cover all taxpayers by July 2025.

On February 9, 2024, the Inland Revenue Board of Malaysia (IRBM) published updated E-Invoice guideline (version 2.2) and E-Invoice specific guideline (version 2.0). The updated version includes several editorial changes and clarifications. Additionally, on the same date, the IRBM released a beta version of the E-Invoice Software Development Kit (SDK). These updates set the stage for the impending transition.

At the onset, E-Invoicing seems to be merely a technological shift and mandatory regulatory compliance. However, the impact of this mandate-driven digitization is far-reaching. Hence, it’s imperative to formulate a strategy and action plan for a smooth E-Invoice implementation in Malaysia.

E-Invoice Implementation in Malaysia Mandate in a Nutshell

E-Invoice in Malaysia is implemented phase wise based on turnover of business. The first phase covers business with turnover exceeding RM 100Mn. However voluntarily opting for e-Invoice is allowed.

Malaysian E-Invoice is designed to serve the purpose of substantiating the income earned by the business and the expenses incurred by the business from tax compliance perspective. Thus, e-Invoices are to be generated for sales and purchase side of transactions. However, there are some exemptions and some special scenarios overriding the general applicability of e-Invoice generation.

Within transactions, there are different levels of e-Invoice generation, for example, single e-Invoice and consolidated e-Invoice; the timing of e-Invoice generation hence varies. There are 4 business documents i.e., Invoice, Debit Note, Credit Note and refund note (collectively referred to as invoices henceforth).

Also important to note, e-invoicing flow is not just limited to registering invoice with IRBM system and getting a unique invoice number, but also rejection of e-Invoice by buyer and subsequent cancellation by seller is permitted.

Overall, the e-Invoice mandate has many aspects and hence it is critical to know the scope and finer points as businesses will need to consider these while the approach being decided to be e-Invoice ready.

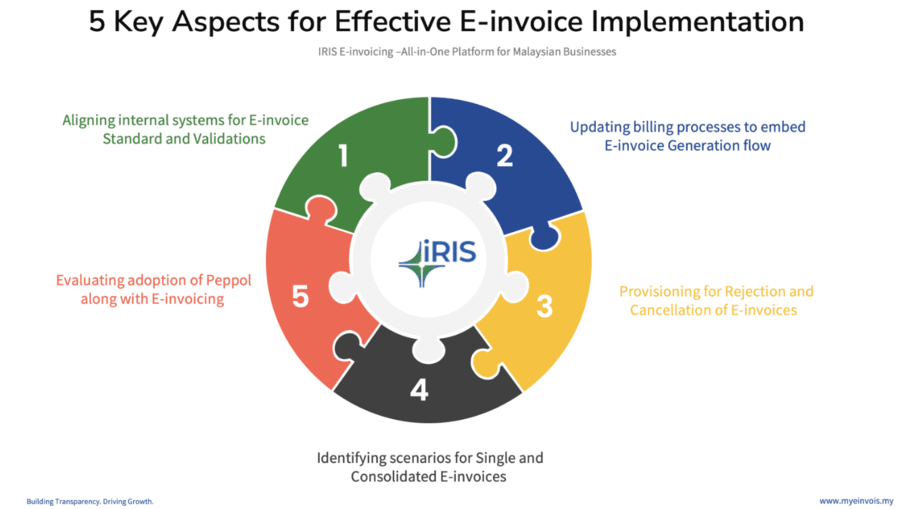

Key Aspects to Consider for Being E-Invoice Ready

Some key areas businesses should look at and incorporate in their e-invoicing journey for accurate and timely compliance.

Aligning Internal Systems for e-Invoice Standard Data and Validations

One of the key benefits that E-Invoice offers is standardization. All entities in Malaysia will be using the same set of data fields as published by IRBM while preparing their invoices.

E-Invoice standard in Malaysia has 55 broad information categories or data points covering details which are typically reported in any document, such as supplier details, buyer details, goods and services sold, value, quantity, taxes applied and so on.

Malaysian businesses need to analyze the data points expected for e-invoicing, the computations of totals and sub-totals and the validation rules associated with the data.

While the E-Invoice standard considers the common business practices, industry-specific scenarios must be addressed. Further there could be some information which needs to be collected and maintained such as buyer’s identification numbers, if not already being captured.

The IRBM system provides a Unique Reference Number (UIN) and QR code which needs to be used to indicate it’s a validated invoice. While updating internal systems, provision to store these new data points needs to be factored in

Updating Billing Processes to Embed e-Invoice Generation

Malaysia has adopted Continuous Transaction Control (CTC) approach for E-invoicing wherein businesses need to obtain E-Invoice through Government system before sharing it with customers. In certain cases, reporting of consolidated information post-transaction is allowed.

At high level the E-Invoice process flow in Malaysia is as follows

- Regular invoices to be generated by businesses as usual, in their ERP or billing systems

- Submit the details of invoice generated to the IRBM system. This can be done using Government portal or APIs or platforms such as IRIS E-Invoicing

- IRBM system validates the invoice details. On successful validation, a unique number and QR code is issued and is shared with the issuer of invoice

- Businesses need to include Unique Invoice Number and QR code on their E-Invoice and share the same with customer

In the case of consolidated reporting, data of all regular invoices needs to be aggregated and invoices corresponding to the aggregated data needs to be generated within 7 days of period end.

Businesses need to upgrade their billing processes to support E-Invoice generation and update invoice print format to include UIN and QR code.

Provisioning for Rejection and Cancellation of E-Invoices

In normal course of businesses, scenario for correcting invoices or cancelling may arise and hold true also under e-invoicing. Apart from generation, businesses can cancel e-Invoices generated by them. As a buyer, the business can reject the e-Invoice generated by the supplier. The supplier receives the rejection request and is allowed to cancel the e-Invoice

Both cancellation and rejection need to be done within 72 hours of e-Invoice generation. Post this stipulated time, any rectification in invoice or transaction should be routed through issuance of credit notes and debit notes

Identifying Scenarios for Single and Consolidated E-Invoices

E-Invoice in Malaysia serves the purpose of being proof of income (for suppliers) and proof of expense (for buyers). Suppliers need to generate E-Invoices for all their sales transactions, however whether to generate separate E-Invoice for every transaction or get a consolidated E-Invoice depends on whether the buyer needs an E-Invoice for tax deduction purposes.

B2B transactions will require E-invoice at a transaction level so that the parties to the transaction (both being businesses) can manage their tax compliances effectively. However, there are cases such as high-value B2C transactions where necessarily e-Invoice for every transaction is needed.

E-Invoice for purchase transactions covering imports, reimbursements, disbursements, foreign income etc. are some key areas where the business might need to generate E-Invoice so that proof of expense is established. e-Invoices for such transactions will be at transactional level and no consolidation is allowed.

Businesses should do detailed impact analysis considering all their business scenarios and the E-Invoice method to be followed for each of the scenarios

Evaluating Adoption of Peppol Along with E-Invoicing

Along with E-Invoicing, Malaysia has also embarked upon Peppol implementation. The Malaysian Digital Economy Corporation (MDEC) is actively spearheading the initiative to promote interoperable e-invoicing, aimed at facilitating smooth exchanges of E-Invoices among businesses (B2B), while IRBM is focused on tax compliance.

Peppol International Invoice (PINT) is tailored to meet the specific needs of Malaysian businesses and tax regulations referred to as MY PINT. By embracing Peppol, businesses in Malaysia can seamlessly exchange E-Invoices within the Peppol network, ensuring compliance and efficiency. The E-Invoice data standard as published by IRBM are aligned to MY PINT.

Businesses are encouraged to evaluate the benefits of Peppol implementation along with E-Invoice upgrade activity. This could help streamlining their invoicing processes and enhancing their digital capabilities while working with global counterparts who are already Peppol ready.

Preparatory Activities Successful E-Invoice Roll-out

Once you have formulated your e-invoicing implementation approach, consider the following to expedite your readiness for e-invoicing:

- Familiarize your teams with the latest specifications and guidelines on E-Invoice data standards. Keep yourself updated with new developments and changes published by IRBM

- Connect with your customers and check their readiness for E-Invoices. You may also consider taking their preference for E-Invoice whether single or consolidated

- Update your customer and vendor master with their identification details and whether covered under e-Invoice

- Start conversations with stakeholders (e.g., Finance, IT) who are likely to be impacted by e-invoicing implementation.

- Select an E-Invoice partner who can provide your flexibility to work with your data and your systems with minimum disruptions

IRIS E-Invoicing – The Go-to-Solution for Malaysian Businesses

IRIS is a leading global provider of compliance solutions, offering a comprehensive suite that encompasses Tax Compliance, Bank and Regulatory Compliance, and more. Drawing from our successful experience in developing and implementing E-Invoicing solutions in India, we are proud to announce the launch of our tailored E-Invoicing solution for Malaysia. Positioned as a premier choice in the realm of E-Invoicing, the IRIS E-Invoicing solution seamlessly integrates with billing systems, facilitating the generation of E-Invoices without disruption to business operations.

IRIS E-Invoicing Solution helps in meeting diverse businesses needs while ensuring compliance and efficiency in managing invoicing processes.