If the word ‘FATCA’ brings a crease to your forehead, you’re not alone. With the first mandatory filing kicking off in 2015, financial institutions need to gear up for the second filing under the Act, the last date for which is May 31, 2016.

For those who are yet to start filing to the tax authorities for FATCA, here’s a quick primer. In July 2015, the Government of India (GOI) signed the India IGA with the U.S. agreeing that financial institutions in India would comply with the Foreign Account Tax Compliance Act (FATCA).

In June 2015, India also joined the Multilateral Competent Authority Agreement (MCAA) of the Organization for Economic Co-operation and Development (OECD). Under this agreement, financial institutions are mandated to obtain information on their accounts and exchange it with other jurisdictions on an annual basis, according to the Common Reporting Standards (CRS) issued by the organization.

To club the process for information sharing and ease the load on filers, the governing rules of the Income Tax Act of India have been amended to provide for the registration of persons, due diligence procedures, and maintenance and reporting of information by Indian financial institutions.

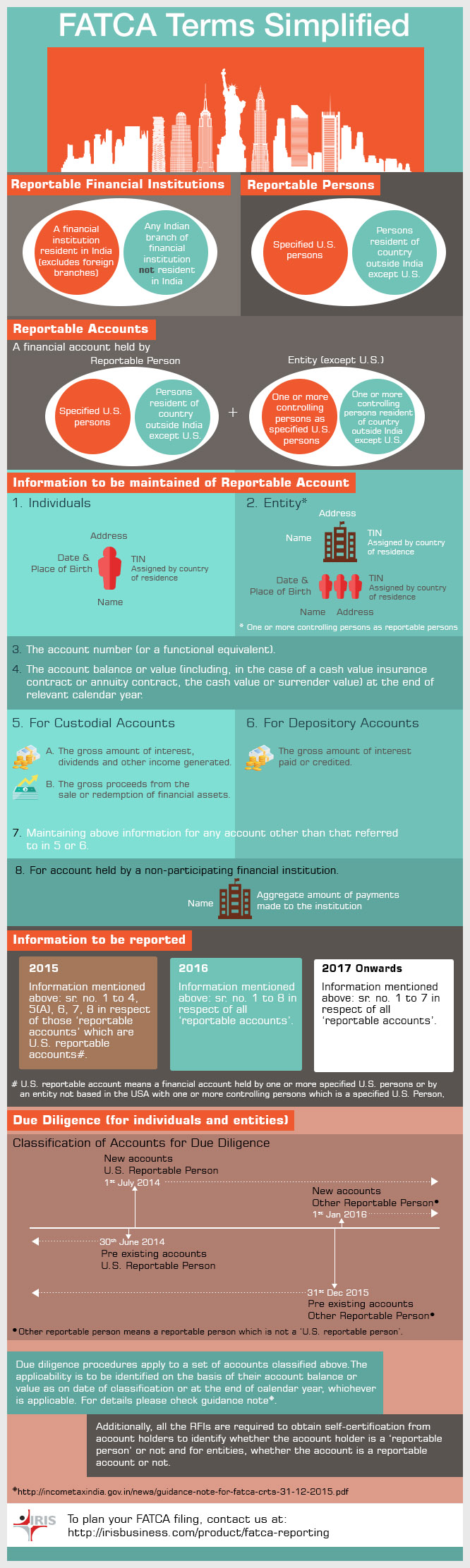

The following infographic can help you understand the amendments in Rule 114 F, Rule 114 G, and Rule 114 H of the Income Tax Act.

How do you need to submit information

For all the reportable accounts, the reporting financial institutions (RFI) have to submit the above-mentioned information as and when due every year by May 31st. In case the RFI has no accounts identified as ‘reportable accounts, it will have to furnish a ‘NIL’ statement of reportable accounts.

The statement of reportable account has to be furnished in Form No. 61B. The deadline for submission of the statement of reportable account for the calendar year 2015 is May 31, 2016. The statement of reportable account shall be furnished electronically under a digital signature to the Director of Income Tax (Intelligence and Criminal Investigation) or the Joint Director of Income Tax (Intelligence and Criminal Investigation).

Electronic format for preparation of a statement of reportable accounts

The prescribed schema for the report under form 61B can be downloaded from the e-filing website. At the time of submission, the RFI will be required to submit the calendar year and the reporting entity category for which the report is to be submitted. The reporting financial institution will then be provided the option to upload Form 61B. The form is required to be submitted using a digital signature certificate.

“Validation” elements must be present for all data records in a file and an automated validation check should be undertaken. The filer should do a technical check of the data file content using XML tools to make sure that all ‘validation’ elements are present. The Income Tax Department will also do so and if data is found incorrect, will reject the file.

Non-compliance Will Attract Penalties

The RFI may attract penalties in the case of:

1. Failure to furnish:

► RFI may attract penalties in case of failure to furnish a statement of reportable account within the prescribed time limit.

► It may also attract penalties in case of failure to furnish a statement within 30 days of receipt of the non-submission notice.

2. Inaccurate information submitted:

The RFI can be levied penalties for furnishing inaccurate information in the statement of reportable account where:

► inaccuracy is due to failure to comply with due diligence requirements or is deliberate on the part of the RFI; or

► the RFI knows of the inaccuracy at the time of furnishing the statement of reportable account, but does not inform the prescribed income tax or such other authority or agency; or

► the RFI discovers the inaccuracy after the statement of reportable account is furnished and fails to inform and furnish the correct information to the income-tax or any other authority or agency within 10 days.

In essence, as the deadline for FATCA inches closer, organizations have no choice but to comply. And the sooner this is done, the better.

IRIS’ FATCA Reporting Application, is a standalone desktop solution for all your FATCA reporting needs. In India, over 14 entities, including banks, insurance companies, and mutual funds have used the application to file their first-year FATCA reports to the local tax authority, the Central Board of Direct Taxation (CBDT). The application with its easy-to-use interface and built-in business validations, when combined with our expert-assisted services can become the only solution you will ever need to comply with FATCA.