ESG stands for Environmental, Social, and Governance (ESG). It is a business review of a company’s economic, environmental, and social impacts, caused by everyday business operations and activities.

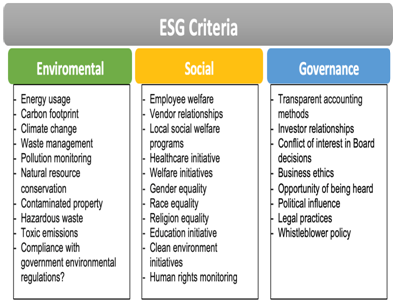

ESG business review is done based on ESG criteria which are broadly classified into three major categories Environment, Social, and Governance, and into their respective sub-categories. ESG criteria and ratings are getting significant traction amongst the investor community to conclude their investment decisions. Many Asset Management Companies, Brokerage firms have also started to offer ESG portfolios for investors to invest in. ESG criteria-based investments are also referred to as sustainable investing, responsible investing, impact investing, or socially responsible investing.

ESG criteria can greatly help investors avoid companies that might pose a greater financial risk due to their environmental or other practices and may be liable for regulatory sanctions. For instance, recent events of BP’s 2010 oil spill and Volkswagen’s emissions scandal had a significant impact on stock prices and resulted in huge losses.

Global Sustainable Investment Alliance (GSIA) 2018 review has stated, “Globally, sustainable investing (ESG-based investments) assets in the five major markets stood at $30.7 trillion at the start of 2018, a 34 percent increase in two years.”

Global ESG frameworks

ESG frameworks provide logic to analyze various ESG sub-categories, and give them weights based on their relevance and importance to eventually determine a percentile of ESG compliance for an entity. This percentile is also used to determine the ESG rating for the concerned entity.

The Global Reporting Initiative (GRI)

The GRI is the most widely used framework. The framework was established in 1997 however was recently updated apart from environmental practice to include human rights practices, governance, and social responsibilities.

United Nations Sustainable Development Goals (SDGs)

To achieve Sustainable development by 2030, the united nations member states established SDG in 2015. There are broader level sustainable goals provided within the framework at the country and society level but may have less impact on the industry level indicators.

Task Force on Climate-related Financial Disclosures (TCFD)

G20 Financial Stability Board established TCFD to develop a framework that will enable entities to assess climate risk and take necessary action to counter it. TCFD aims to establish transparent ESG metrics to make world economies better prepared for climate change.

The Sustainability Accounting Standards Board (SASB)

SASB has published ESG standards in 2018 explaining underlying financial metrics and their implementation. SASB ESG framework is best suited to analyze financial performance based on the ESG practices followed by an entity.

Morgan Stanley Capital International (MSCI)

A privately created ESG framework by Morgan Stanley specifically identifies ESG risk in the investment decisions taken by the firm. ESG risks are determined through a scoring system covering data points across industry sectors and rating ranges from CCC (laggard) to AAA (leader).

ESG in India

ESG reporting was limited in a way through BRR reporting and CSR (Corporate social responsibility) reporting.

Business Responsibility Reporting (“BRR”) is a report (part of the annual report) submitted to Indian stock exchanges by the top 1000 listed entities by market capitalization. Non-submission of BRR is considered as a violation of Clause 55 of the Equity Listing Agreement.

BRR’s reporting philosophy was to make the listed company accountable to stakeholders and also at the same time to be environmentally sustainable.

In May 2020, Committee on Business Responsibility Reporting developed and recommended Business Responsibility and Sustainability Report (BRSR) be integrated with the MCA21 portal. SEBI (under the guidance of MCA) in March 2021 made BRSR reporting applicable to the top 1000 listed entities (by market capitalization).

To start with, BRSR reporting would be voluntary for FY 2021–22 and will be made mandatory from FY 2022–23. Going forward, the applicability is proposed to be extended to all companies and even LLPs in 5 years starting from FY 2021-22.

The BRSR Framework

The BRSR framework consists of two separate formats.

Comprehensive BRSR

Applicable to the top 1000 listed entities in India and may be extended to other listed entities based on the threshold.

BRSR Lite

Applicable to non-listed entities which have a simple structure to encourage more companies to begin sustainability reporting. BRSR Lite is voluntary for adoption by non-listed entities.

BRSR | Summary of Disclosures and Principles

Sections A and B focus on “quantitative data” while Section C focuses on “qualitative data”

| Sections | Disclosures |

| Section A: General information | Top 3 product details |

| Plant/ office locations | |

| Employee/ workmen details | |

| Financials and Ownership | |

| Section B: Policies | Policy and Management processes |

| Governance, leadership, and oversight | |

| Stakeholder engagement | |

| Communication | |

| Section C (Principle # 1) | Complaints of bribery/ corruption |

| Disclosure of interest by directors | |

| Training/awareness programs on principles | |

| Meeting with shareholders on responsible business conduct and sustainability | |

| Transparency and disclosure details | |

| Section C (Principle # 2) | R&D and Capital expenditure |

| Input materials and their sourcing | |

| Usage of recycled/reused inputs | |

| Section C (Principle # 3) | Measures for the well-being of Employees and workmen |

| Payment of minimum wages and training to staff | |

| Details of unions and assessment of child labor, sexual harassment, and likewise | |

| Section C (Principle # 4) | Protection of stakeholder’s interest |

| Section C (Principle # 5) | Protection of human rights (employees/ workmen/ differently-abled) |

| Details of remuneration | |

| Number of complaints | |

| Section C (Principle # 6) | Air and liquid emission details |

| Solid waste generation and management | |

| Section C (Principle # 7) | Affiliation with associations/ industry chambers |

| Details of energy and water consumption | |

| Section C| (Principle # 8) | CSR beneficiaries |

| Section C | (Principle # 9) | Details of products with a focus on value to consumers |

Source: – https://www.mca.gov.in/Ministry/pdf/BRR_11082020.pdf

ESG Reporting and Data Standards

In 2020, OECD released its report on Sustainable and Resilient finance which states that over $30 trillion is attributable to ESG investing in recent years. Also, more than twenty-five percent of publicly listed companies around the world are now ESG measured and rated.

Amidst the rush for ESG investing, Investors and regulators need better data on entities’ ESG performance to strategize ESG-based regulations and compliances.

World-over, many regulators are yet to identify preferred data standards for reporting ESG data. Similarly in India where MCA/SEBI made ESG reporting part of the MCA21 portal but did not specify if the data will be XBRL-is.

IASB has already initiated a discussion to establish IFRS-based ESG standards which will be made part of IFRS XBRL taxonomy, it’s inevitable that an equivalent update in IND-AS and MCA XBRL Taxonomy will occur.

It is ideal for SEBI/MCA to establish a data standard for ESG data reporting at the inception of ESG evolution in India. Data Standards like XBRL, iXBRL, and SDMX have garnered immense importance in business reporting in recent years mainly because they are open source, have globally accepted data structures, and have abundant software, and human resources availability.

In India, even with modern technologies in place ESG Data too is not devoid of;

- Lack of accounting standards – in the absence, the measure for ESG metrics will be interpretational-based.

- Lack of regulations – many of the required ESG data are still not recorded in business books to derive quality metrics due to the lack of ESG regulations.

- Lack of technology – to record, store, report, analyze, and publish, all are use cases for necessary software, and hardware up-gradation required at entity and regulatory levels.

In today’s time when climate crisis is felt by every individual on planet Earth, it’s of crucial importance to have a robust ESG-based book-keeping, publication, regulation, reporting, and rating framework in place for every country, especially in India which is eying to be an economic superpower this decade.