NRB Reporting

Regulatory Reporting

to NRB SIS

with IRIS iDEAL®

The NRB Mandate

Reporting in Nepal

The Nepal Rashtra Bank, the central bank of Nepal launched the pilot of Supervisory Information System (SIS for commercial banks and infrastructure bank as a pilot test from January 8, 2019.

Based on Supervisory Information System (SIS) Implementation Action Plan, 2022 approved by the Nepal Rastra Bank (NRB) Board on December 20, 2022, NRB started phasing out the existing system on Daily Liquidity (NRB01) and Interbank Transactions (NRB02) reported by Class A, B, C & IDB and

started to rely fully on data reported through SIS from mid-January, 2023.

Similarly, NRB has issued circular to Class A, B, C & IDB regarding start of monitoring of compliance related data from SIS from mid-July, 2023 and concerned Supervision Departments has started to monitor the compliance based on data reported in SIS*

With the SIS implementation, NRB has taken a significant step in modernizing the financial

regulatory landscape by implementing an XBRL-based electronic filing system for its Supervisory Information System (SIS).

The

Supervisory Information System (SIS)

Entities should submit the required applicable returns and other required information in specified formats (XBRL or Non-XBRL) and in specified intervals in SIS.

Users can view the submitted returns as well as the pending returns to be filed in the SIS portal itself.

The 3 SIS Modules

Offsite (NRB iFile Installer)

Onsite

Output (Business Intelligence)

Non-XBRL Returns

N001 – N020

IRIS iDEAL®

Your Comprehensive Solution for NRB Compliance

IRIS iDEAL® provides seamless end-to-end automation, streamlining the entire process—from data extraction across multiple sources to reporting in NRB SIS. It is designed to:

Frequent Changes

Handling Large Volumes

Ensuring the Highest

of Data Quality

data-security

and Confidentiality

Manage Compliance Burden

Burden efficiently

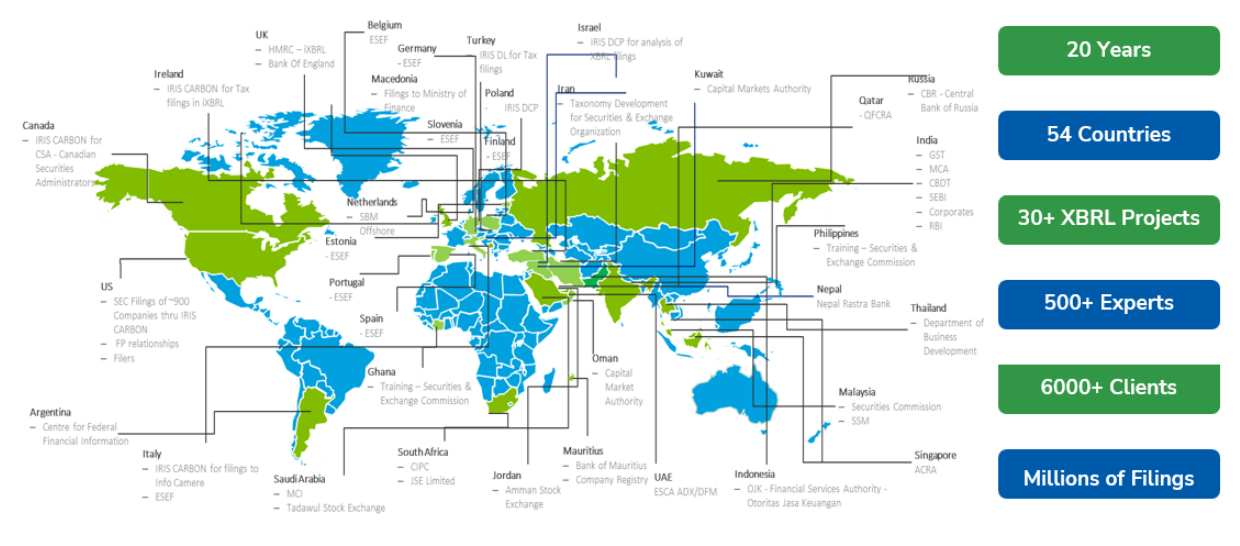

The IRIS Advantage

Key Features of iDEAL

The iDEAL® Advantage

Save Time and Resources

Enhance Data Quality and Consistency

Reduce Compliance Costs

Testimonials

What our Clients speak

IRIS-NRB

IRIS Blog

Experience the IRIS iDEAL® Difference

Ready to simplify your regulatory reporting?

Discover the power of IRIS iDEAL® – the trusted solution for financial institutions worldwide.