As per a recent press release from the Ministry of Corporate Affairs (MCA), 460 listed companies spent Rs. 6,337 crores in FY 2014-15 on Corporate Social Responsibility (CSR). Out of these, 51 are public sector undertakings while 409 are private sector companies.

CSR activities that were earlier a voluntary initiatives by businesses have been made mandatory in India since 2014 through the provisions of the Companies Act, 2013. What has also become mandatory is the disclosure of the amount and how it is spent.

In response to the mandate, the MCA, which receives companies’ annual filings in XBRL format, has recently updated the annual filing form (AOC-4), to incorporate the CSR disclosure requirements. Let me take you through the amendments in the XBRL form, how the CSR reporting requirements are included in the MCA taxonomy, and of course how they are to be disclosed in XBRL.

Accounting for and Disclosure of CSR activities

Although CSR activities are not related to the business of the Company, CSR spending has accounting implications. Schedule VII of the Companies Act 2013 and section 135 of the same Act specify the compliance requirements for CSR and the ICAI’s Guidance note on CSR mentions the accounting and measurement of CSR disclosure.

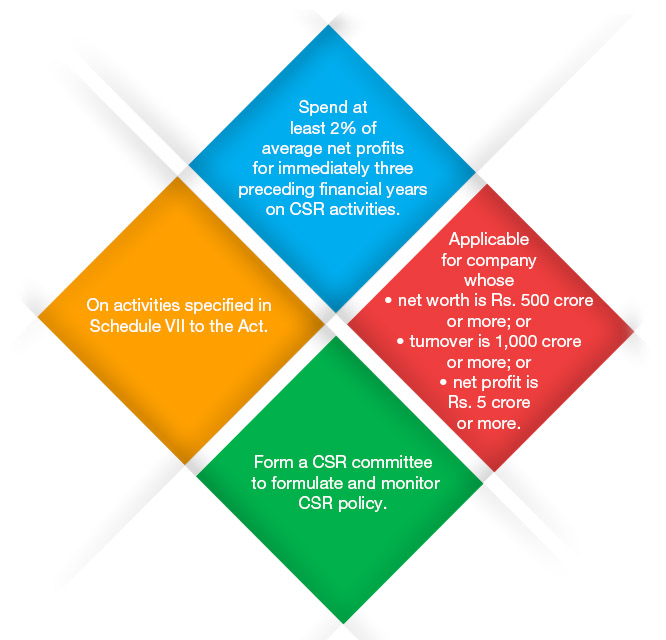

The Companies Act, 2013 requires a certain class of companies to spend at least 2% of their average net profits (for immediately three preceding financial years) on CSR activities. The Act requires a CSR committee to be constituted, to formulate and monitor the CSR policy of the company.

Here is a summarized pictorial representation of what the Act says about CSR:

CSR in MCA Taxonomy

The XBRL taxonomy catering to the filing requirements of the MCA has been developed and maintained by The Institute of Chartered Accountants of India (ICAI). IRIS consultants have been providing advisory and taxonomy development services for updating the MCA taxonomy to include all the changes, including CSR requirements.

The Draft CNI taxonomy 2016 includes a section dedicated to the information contained in an annual report on CSR expenditure and includes granular as well as high-level data. Some examples of granular details include

1. Bifurcation of the amount spent: The amount spent on CSR is to be further bifurcated as the amount spent on the construction/acquisition of any asset and the amount spent other than on the construction/acquisition of any asset.

2. Details of every expense under CSR – For the CSR expenditure, the program details such as the mode of payment, sector on which spent, region, etc. are to be disclosed as per rules. This information, which can be visualized as a table with many records, is also modeled in the taxonomy.

Additionally, certain descriptive disclosures concerning CSR expenses are to be included in the Directors’ Report, CSR policy, etc. are also defined in the taxonomy.

There are about 50 reportable items in the CNI taxonomy catering to CSR requirements. The items are of varied types such as monetary, textual, and some very specific where a list of allowed items is already defined in the taxonomy.

The Draft CNI Taxonomy 2016 and related business rules are available for public comment.

CSR Reporting: A Global Phenomenon

Once a voluntary activity, CSR after the mandate might well be more of an arduous responsibility for some corporate houses. But the transcending convention, CSR information does find a place in a company’s report. And if the information is captured in XBRL, a good level of standardization can be achieved across CSR disclosures.

Globally, we do see a trend of non-financial reporting domains coming under XBRL, such as the Global Reporting Initiative (GRI) for sustainability reporting and the Carbon Disclosure Project for environmental impact. This goes to show that along with financial data, non-financial information also impacts overall policymaking. We hope that with CSR being covered under the MCA’s XBRL mandate, India is taking a step forward in having more data sets in a digitized and standardized format, which in turn will help to make more informed decisions.

All in all, the MCA’s initiative on CSR reporting in XBRL can be considered as a positive step toward better reporting and hence better decision-making. With more than 11 years of experience in the XBRL domain, IRIS has been providing MCA XBRL conversion services and applications to Indian corporates since the MCA mandate in 2011. Get in touch with us today to get your XBRL report ready for MCA filing.